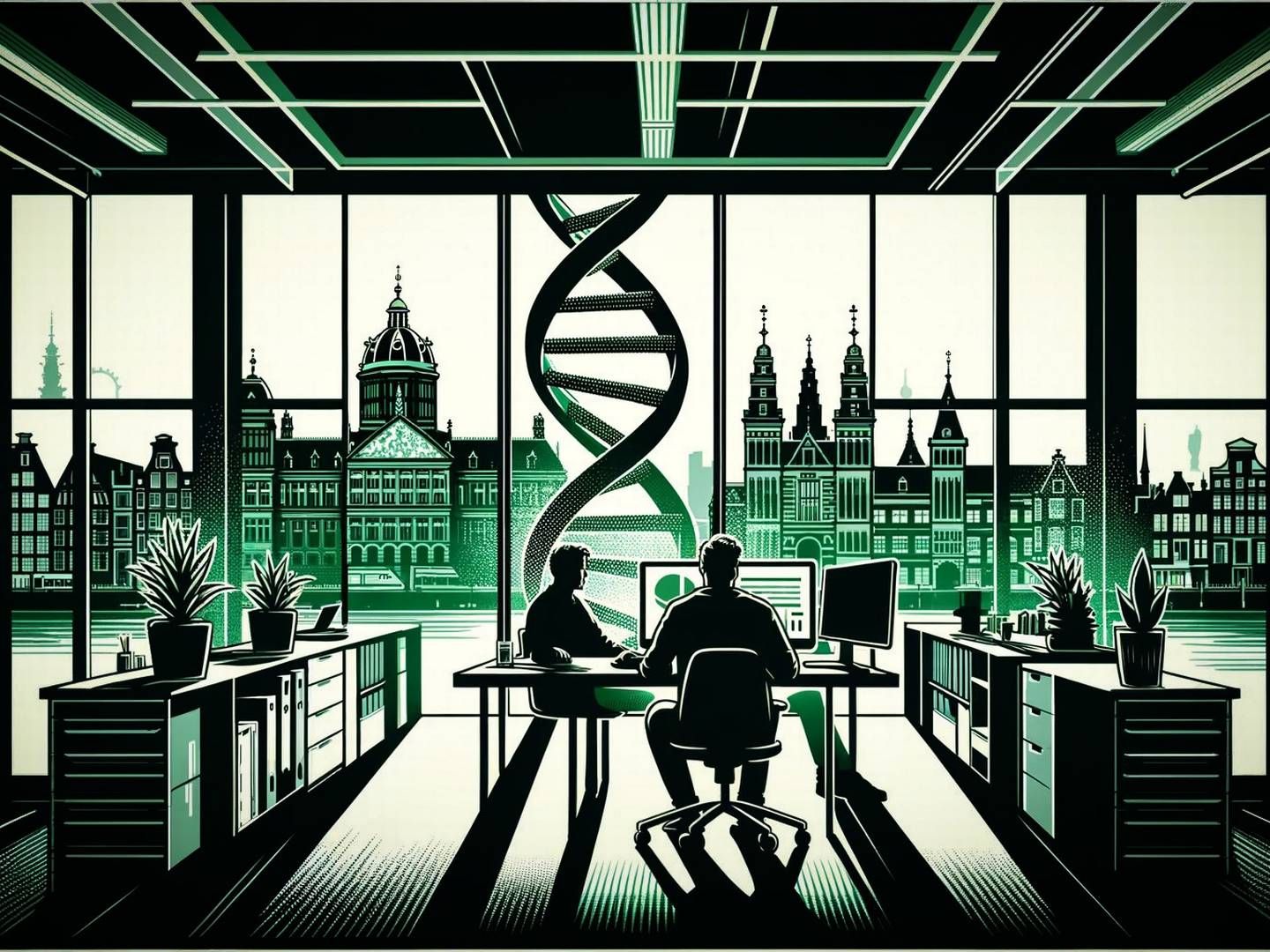

130 countries enter into tax reform agreement

130 countries have agreed to reform the global tax rules.

The new framework will ensure that multinational companies pay fair taxes in the countries in which they operate, according to the Organisation for Economic Co-operation and Development on Thursday.

The strategy for implementing the new rules will be completed in October.

"The framework updates key elements of the century-old international tax system, which is no longer fit for purpose in a globalized and digitalized 21st century economy," reports the OECD.

The plan consists of two main pillars and is the result of OECD negotiations which have been going on for many years.

One part of the framework revolves around securing stability in the global tax system. This will lead to a more fair distribution of taxes in different countries.

The second pillar revolves around company taxes, as the OECD wants to implement a global minimum tax on company earnings.

The minimum tax rate will be 15 percent. This is meant to bring in USD 150bn more in annual taxes globally.

Nine countries, including Ireland and Hungary, do not wish to take part in this deal. Many tech giants are domiciled in Ireland due to its attractive tax regulation.

Related articles

WHO: Europe is far from safe from covid-19

For subscribers

Danish companies: A minimum tax rate has advantages

For subscribers