US sees global tax agreement as beneficial for all

A global tax agreement would benefit all governments and help increase incomes from taxation, as it would put an end to the race to the bottom, says US Finance Minister Janet Yellen at a G20 press conference in Venice, Italy.

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

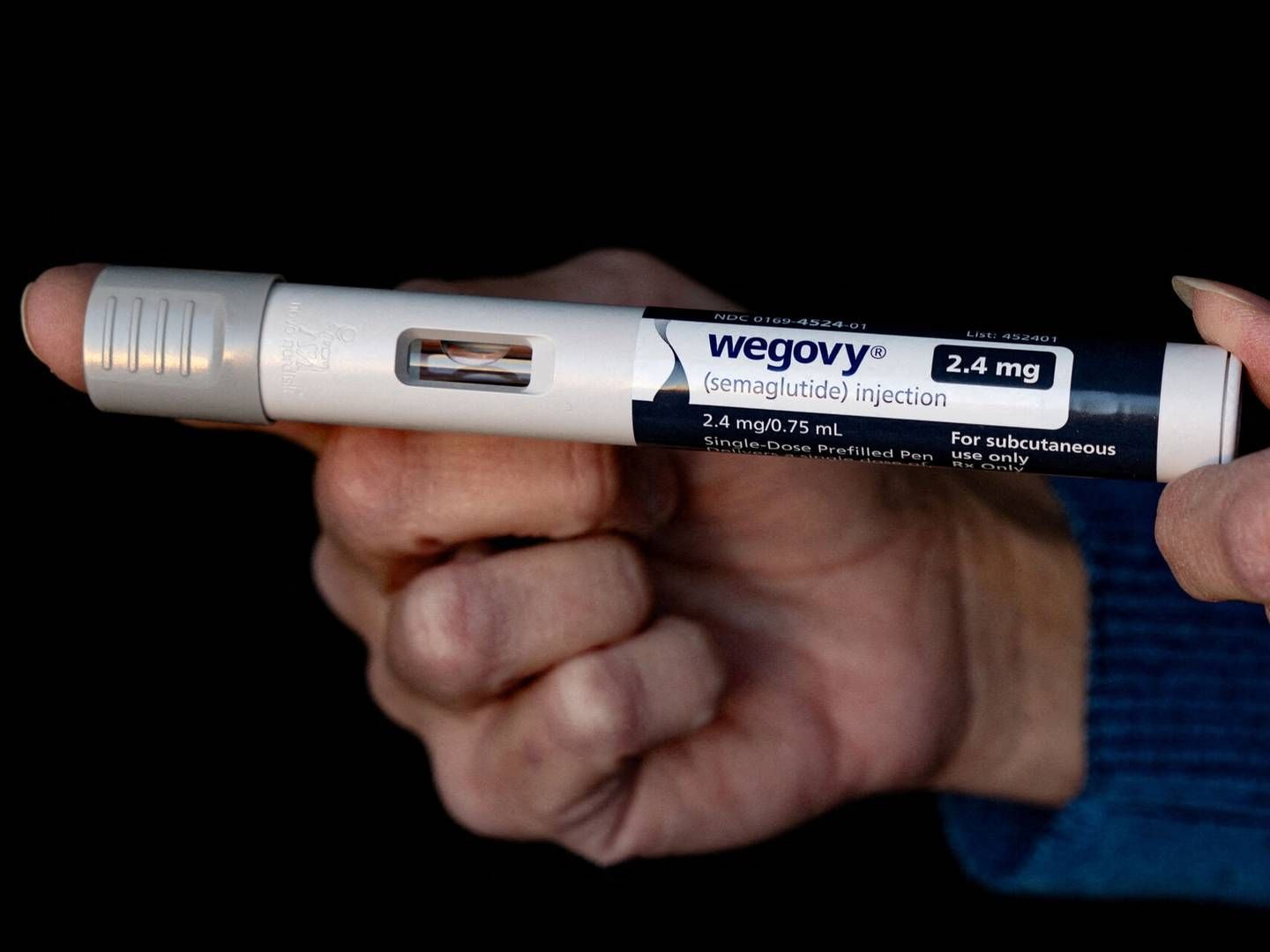

Biden starts new offensive to bring down medicine prices

For subscribers