Analyst: Restricted hospital access in China to dampen Coloplast's quarterly growth

Danish medtech company Coloplast is expected to have faced headwinds during the company’s second quarter of fiscal 2022/2023 from limited hospital access in China and subdued growth from back orders across some divisions, assesses an analyst in anticipation of the report’s release on Thursday.

Overall, Søren Løntoft Hansen, senior equity analyst at Danish investment bank Sydbank, thinks Coloplast’s growth levels will be similar to the year’s first quarter while he expects the company to maintain the full-year expectations that were also lowered slightly then.

”We expect that hospital access in China continues to be limited despite the easing up of Covid-19 restrictions, while back orders for products within the company’s division of Continence Care and Wound and Skin Care put a damper on the quarterly growth picture,” the analyst assesses.

Across divisions, the analyst expects to see medium-to-high single-digit growth rates, with the exception of Wound and Skin Care, which is more affected by restricted Chinese hospitals.

As for Ostomy Care, Coloplast’s biggest division, organic growth of 8% is anticipated despite the Chinese headswinds.

”We assess that lessened market access in spite of the lifted restrictions in the aftermath of Covid-19 will dampen growth in China. On top of that, we expect continued dampened consumer confidence in China,” Løntoft Hansen writes.

Outlier division

Continence Care is expected to have grown organically by 6% driven by a broadly based geographical progress. However, some back orders may dampen growth in what is Coloplast’s second-biggest division, from which revenue of DKK 2bn is anticipated.

Interventional Urology is an outlier with a projected 10% organic growth at sales of DKK 633m.

”We expect that the positive market momentum that the business area has experienced in the latest quarters has continued – driven by a higher number of procedures,” the analyst writes.

As for Wound and Skin care, limited hospital access in China will likely put a damper on growth, which will only amount to 1% organically with sales of DKK 667m.

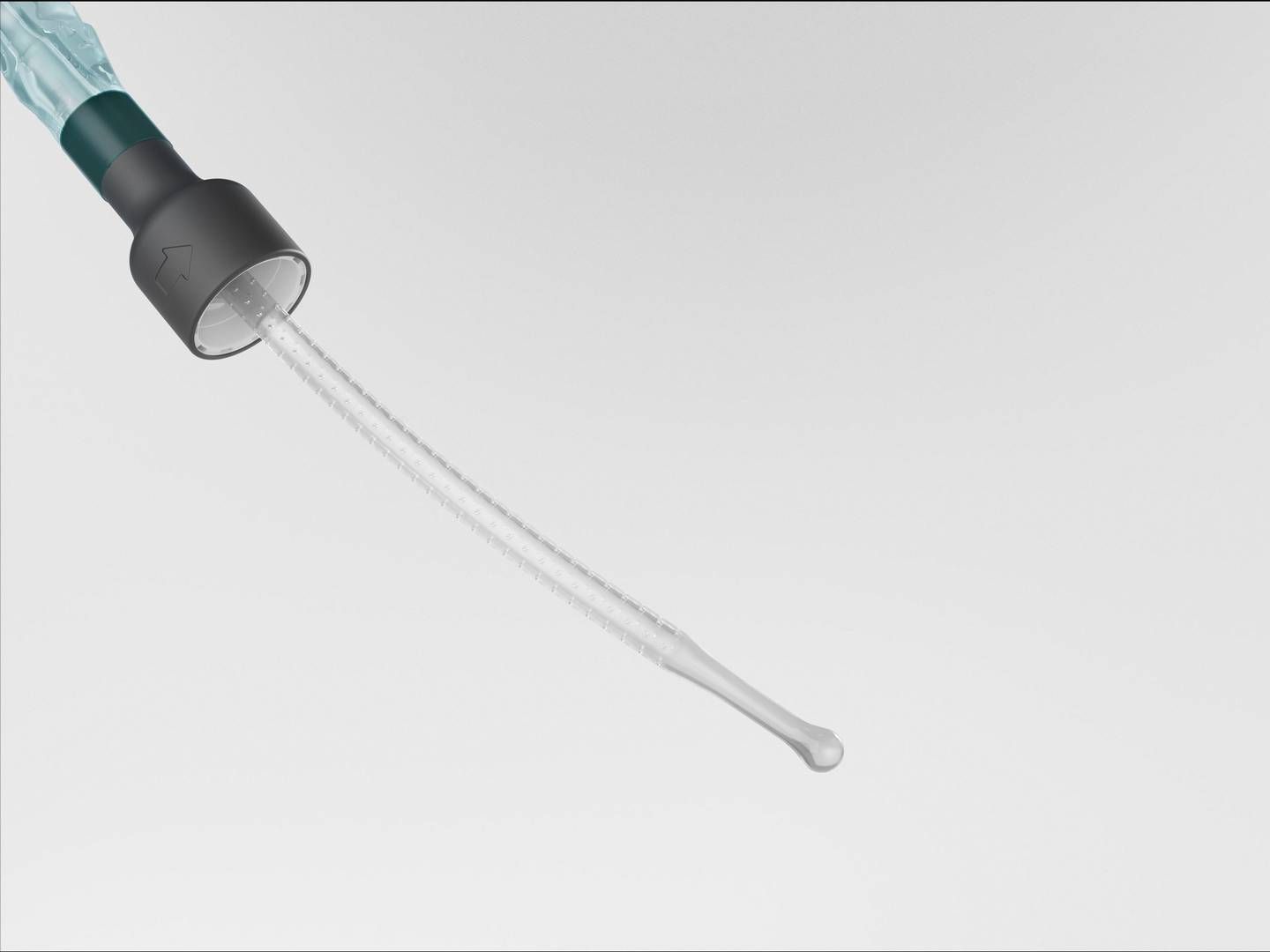

Coloplast’s newest business area, Voice and Respiratory Care, which was established after the Danish medtech company acquired Atos Medical, is seen to book DKK 508m at a high single-digit underlying growth rate in the second quarter.

As for the gross and operating margin, second-quarter setbacks are predicted.

”The gross margin will be positively affected by efficiency improvements, though these are more than offset by increasing wages, energy and commodity prices, and freight costs. We also see increasing capacity costs due to an increasing activity level,” Løntoft Hansen writes.

Sydbank calculates a gross margin of 66.9% against 68.7% in the second quarter of 2021/2022, and also sees an operating margin before special items of 28% against 30.6% between the two quarters.

The guidance stating organic revenue growth of around 7–8% at an operating profit of 28–30% before special items is expected to be maintained.

Related articles

Coloplast's newest business area could become its biggest

For subscribers

Coloplast improves pulmonary health in recent study

For subscribers