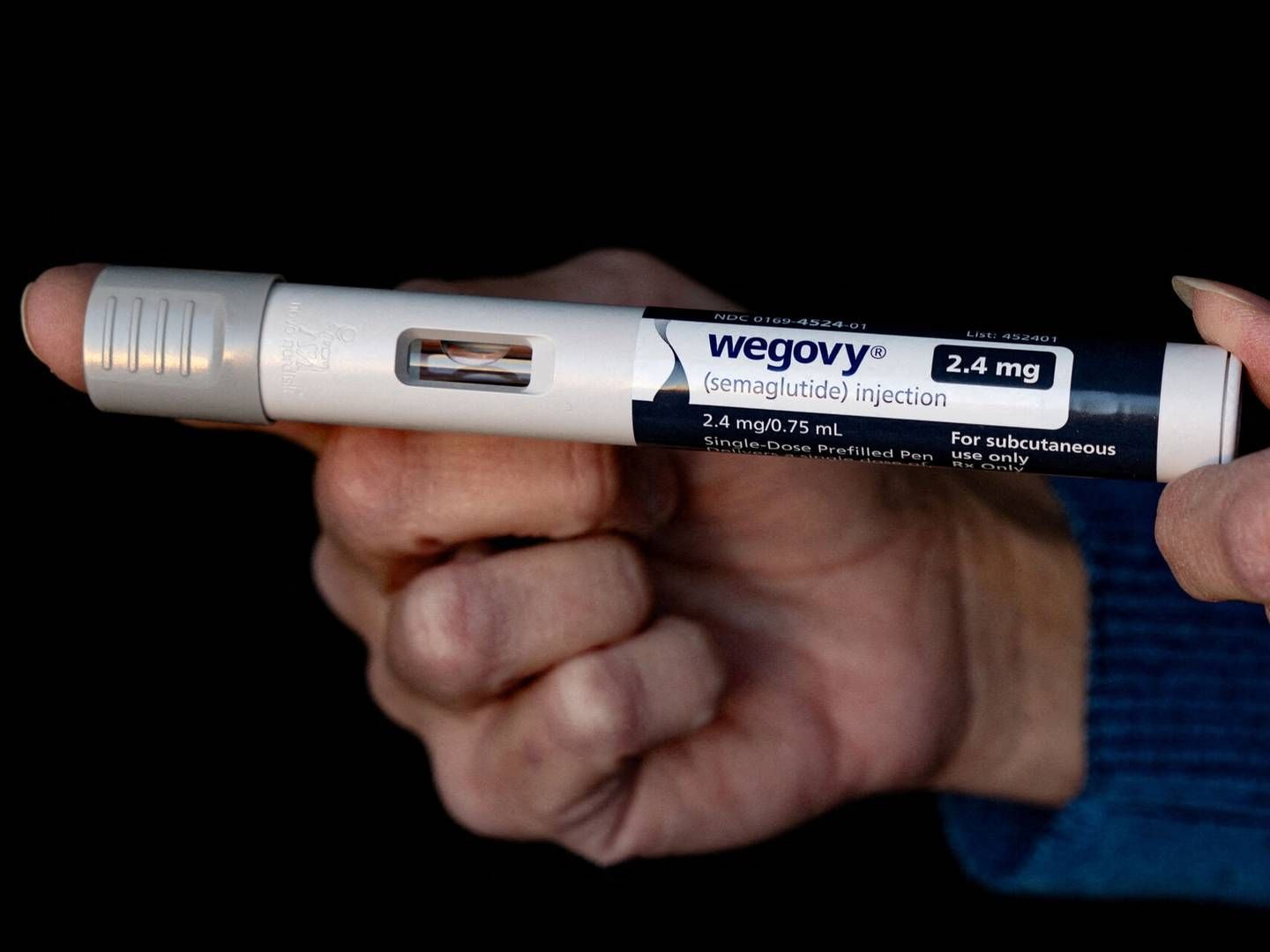

Novo Nordisk's biopharm arm recedes in Q3

The biopharm division at Novo Nordisk could not live up to the progress achieved in the first 6 months of 2021 during Q3.

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

Novo Nordisk Q3 profit surpasses USD 1.8bn

For subscribers

Novo Nordisk upgrades guidance

For subscribers