Pension fund criticizes Genmab salary packages

The new changes in Genmab's salary policy, which were passed during the company's annual general meeting on Tuesday afternoon, were met with a few protests.

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

Analyst: Genmab share price may double

For subscribers

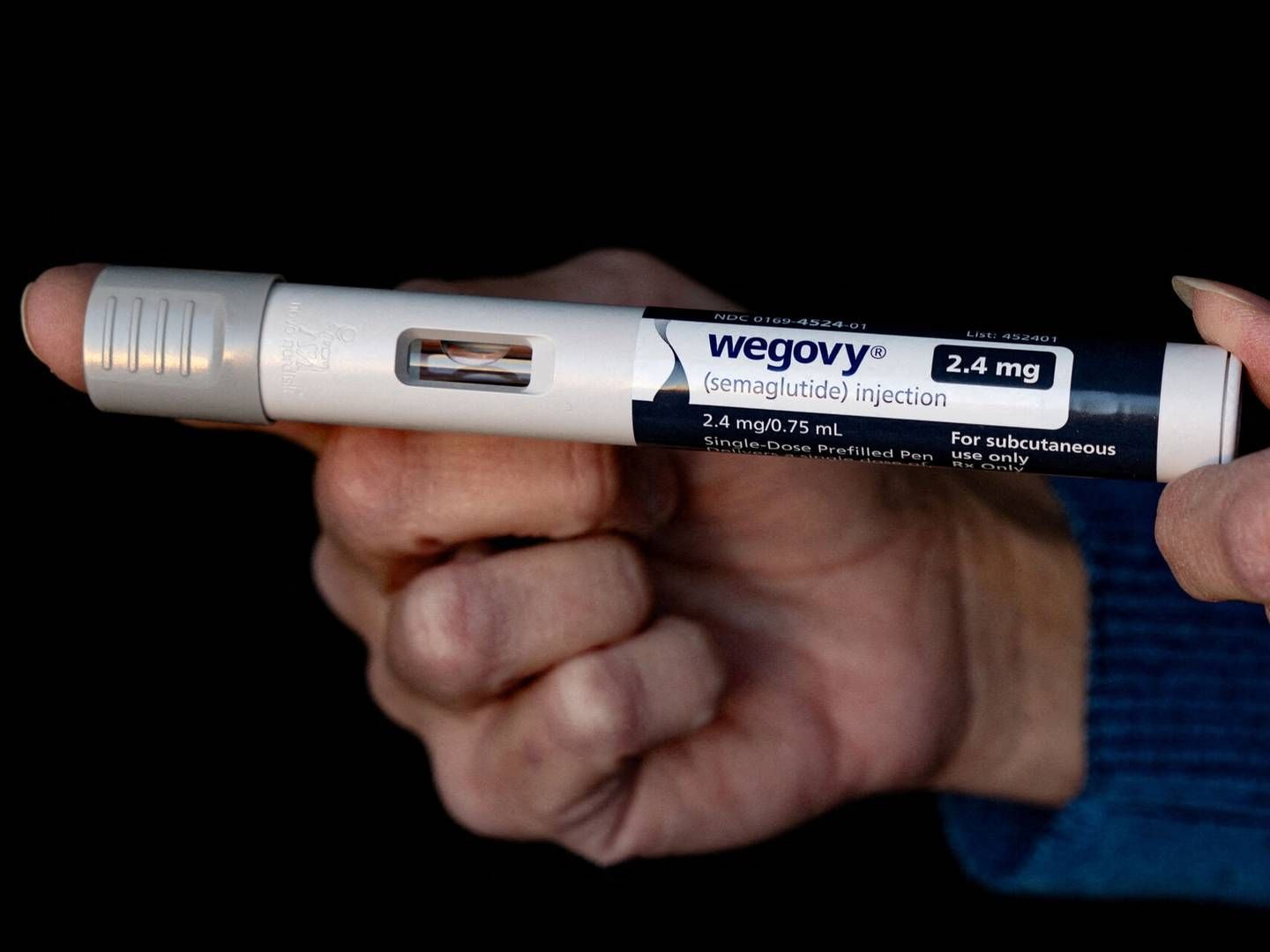

Genmab drug becomes more accessible in the US

For subscribers